Top 10 Strategies for Building a Strong Portfolio

If you want to build a solid investment portfolio, you've come to the right place! Investing is one of the most effective ways to grow wealth and achieve financial goals. However, it can also be more transparent and easier to manage. We've put together the ten best ways to build a healthy portfolio.

These tips will help you make the right decision and get on the road to success. Now, take a sip of coffee and start understanding the concept of becoming a great investor. Let's get it!

Ten strategies every investor should choose to build a strong portfolio

Investing can be overwhelming, especially for beginners. However, with the right approach and mindset, investing could be the perfect time to set sail. To build a strong portfolio, you must be patient and use specific strategies to achieve results. That's why exploring ten key strategies every investor should consider when building a solid portfolio is essential.

1. Determine your investment goals

No matter what you want to invest in, it helps to set goals first. The investor's goal may be to obtain a realistic return on capital. They implement strategic investment projects in renewable energy, infrastructure, logistics, manufacturing and affordable housing. Where will you spend your money? These things can help you analyze what goals you want to achieve and the methods you should use to achieve them.

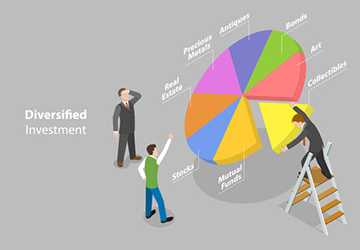

2. Diversify your portfolio

One of the most common mistakes new investors make is investing in a company and believing it will give them all the benefits they seek; this is the stupidest thing you can do. Instead, it would help if you diversified your portfolio across different types of securities. It would be helpful if you analyze which one is the best based on your income and goals.

It allows you to offset losses in one asset class with gains in others, minimizing overall investment risk. If one asset class underperforms, different asset classes can absorb losses.

3. Invest in low-cost index funds

Are you listening to the hype about index funds? They're like the cool kids in the investing world, offering broad market exposure and low fees. Think of them as your trusty companion, helping you achieve market returns without breaking your budget. If you're looking for a convenient and cost-effective investment option, index funds could be your new best friend.

4. Avoid timing the market

Do you have the stock market in mind? However, timing the market can be a risky strategy. Timing the market becomes challenging. So, consider this before taking the plunge and investing in stocks.

Instead, stick to a long-term investing approach that suits your financial goals and stay invested despite market fluctuations. You can enjoy the market's peaks and troughs and eventually reach the top.

5. Rebalance your portfolio regularly

Regular adjustments to your asset mix are the foundation of every successful investment strategy. Over time, the value of your portfolio assets may change, causing actual allocations to differ from planned, contrary to your wishes; for example, this could include selling some overvalued assets and then using the sale Proceeds to buy undervalued assets.

Not only does this help manage risk, but it also ensures you fully understand how specific asset classes are performing. Please optimize your portfolio for better results before it's too late.

6. Have an emergency fund

We understand that unexpected expenses or disruptions to your income can cause stress and anxiety; this is why an emergency fund is so important. It provides a safety net and comfort, giving you a financial cushion when needed.

Additionally, an emergency fund can help you avoid withdrawing investments prematurely and ultimately harming your financial goals. Therefore, prioritizing building an emergency fund as part of your investment strategy is always a good idea.

7. Invest in quality companies

Quality business investments will help maintain your portfolio stability and profitability over the long term. Look for companies with good earnings, strong balance sheets and competitive advantages. As a beginner, you can invest in successful companies that generate high returns.

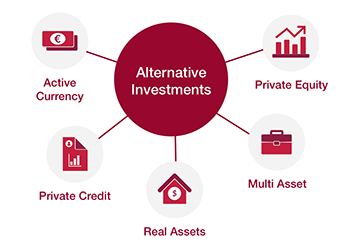

8. Consider investing in alternative assets

Diversified investors looking for high returns may consider alternative investments such as real estate. While these types of investments have the potential to provide attractive financial returns, they also have certain drawbacks. One of the biggest challenges is that they can be illiquid, meaning it can be difficult to sell them quickly when needed.

In addition, investing in alternative assets requires more rigorous due diligence due to their complexity and unique nature. Despite these challenges, many investors find that alternative investments can be a valuable addition to their portfolios, helping reduce risk and potentially increase long-term returns.

9. Stay informed and educated

Learning is critical to investor success, as is staying current on the latest market trends, economic indicators, and company news. Knowledge helps make sound investment decisions and prevent costly mistakes. So, be careful and keep learning to achieve your investment goals.

10. Focus on your risk tolerance

Investing is not a rigid approach. Your risk tolerance and investment goals determine your investment strategy. Those with a risk-averse mindset can adopt a more conservative strategy and increase their bond allocation. However, if you are a risk-taker, you can own higher stakes in more aggressive stocks.

Collapse!

A broad portfolio based on research, diversification and discipline. Here are ten strategies to improve your chances of achieving your financial goals. Think about your long-term goals and never succumb to the temptation to make hasty trades based on short-term market movements.

Regular portfolio reviews and adjustments based on your goals and risk tolerance can minimize your risk of significant losses. As a result, you can gain an impressive collection while suffering substantial losses.